In a strategic move to reshape individual income tax structures, the government has laid out a proposal that promises significant alterations to the legislated "Stage 3" tax cuts. Brace yourselves for the lowdown on these anticipated modifications and their potential impact on your financial landscape.

Revamped Stage 3 Tax Cuts (Effective July 1, 2024):

-

Reinstating the 37% Tax Rate:

- Middle-income earners are poised to witness the reinstatement of the 37% tax rate, a shift from the initially slated abolishment under Stage 3 tax cuts.

-

Reduction of 19% Tax Rate:

- In a bid to support low-income earners, the government proposes to lower the tax rate from 19% to 16% for incomes ranging between $18,200 and $45,000.

-

Adjusted Tax Rate Thresholds:

- The proposed adjustments include reducing the 32.5% tax rate to 30% for incomes between $45,000 and a new threshold of $135,000.

- Raising the threshold for the 37% tax rate from $120,000 to $135,000.

- Elevating the threshold for the 45% tax rate from $180,000 to $190,000.

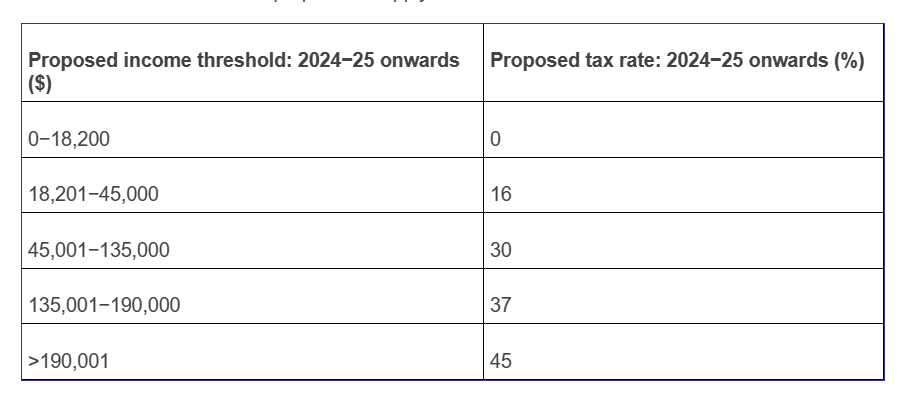

Proposed Tax Thresholds and Rates (2024—25 Onwards):

- $0−$18,200: 0%

- $18,201−$45,000: 16%

- $45,001−$135,000: 30%

- $135,001−$190,000: 37%

- $190,001: 45%

The tax thresholds and rates proposed to apply from 2024—25 are as follows.

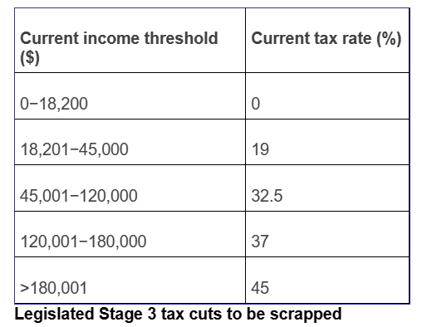

The current tax thresholds and rates for 2023—24 are as follows.

Abandonment of Legislated Stage 3 Tax Cuts:

In an unexpected turn of events, the government has chosen to discard the Stage 3 tax cuts that were set in motion by Act No 47 of 2018 and Act No 52 of 2019. These cuts, initially scheduled to take effect from July 1, 2024, included:

- A 30% tax rate for incomes between $45,001 and $200,000.

- A 45% tax rate for incomes exceeding $200,000.

- The complete abolition of the 37% rate of income tax.

Medicare Levy Threshold on the Rise:

As a complementary measure, the government plans to increase the Medicare levy low-income thresholds for 2023—24. This strategic move aims to provide relief and fairness within the tax structure for individuals.

Stay tuned for further updates on these proposed tax changes. The financial tides are shifting, and it's crucial to stay informed about the waves of change!

Source: Prime Minister, Treasurer and Minister for Finance, Tax cuts to help Australians with the cost of living,